1. Take notes on the case background information

Capital One case interviews begin with the interviewer giving you the case background information. Let’s say that the interviewer reads you the following information:

Interviewer: As an investment, your friend is considering opening up a mini-golf course. Should they do it?

As the interviewer reads you the case information, take notes. It is important to understand what the objective is.

2. Synthesize information and verify the objective of the case

After the interviewer finishes giving you the case information, confirm that you understand the situation and objective. Provide a concise synthesis like the following:

You: To make sure I understand correctly, our friend is considering opening up a mini-golf course as an investment. The goal of this case is to decide whether they should open up a mini-golf course.

Interviewer: Exactly. That is correct.

3. Ask clarifying questions

Next, you’ll be able to ask clarifying questions. Try to limit your questions to only the most critical questions that you need answers to in order to solve the case.

You: Before I begin structuring a framework, can I ask what our friend’s financial targets are for the investment?

Interviewer: Your friend is hoping to make at least $200,000 in profit in the first year.

4. Create a framework

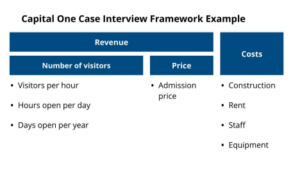

Next, lay out a framework for how you are going to solve the case. A framework is simply a tool that helps you structure and break down complex problems into simpler, smaller components.

For this Capital One case interview example, your framework may look like the following:

You: To determine whether or not our friend should open a mini-golf course, we will need to calculate the expected annual profit. To do this, we need to calculate expected revenues and expected costs.

To calculate revenues, we need to estimate how many people will visit the mini-golf course per year.

We can calculate this by estimating the number of people that come per hour and multiply this by the number of hours per day the mini-golf course is open. To annualize this, we can multiply by the number of days per year the course is open.

If we know the number of annual visitors, we can multiply by the price that the mini-golf course charges for admission to get total annual revenue.

To calculate costs, we need to add up all of the different costs associated with running a mini-golf course. The major costs that come to mind are construction costs, rent, and staff costs to operate the mini-golf course. There are also other minor costs such as the costs of golf balls and golf clubs.

Interviewer: That approach makes sense to me.

5. Perform calculations

Once you have presented your framework to the interviewer and the interviewer has approved of your approach or given you feedback, you will move onto doing calculations.

When you are performing calculations, make sure you are walking the interviewer through each step. You do not want to be doing calculations in silence.

By walking the interviewer through each step of your math, the interviewer can easily follow what you are doing and provide suggestions or further information to help you.

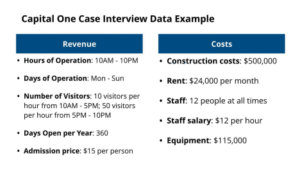

Interviewer: Let’s move onto the calculations. I have the following information for you.

You: Let’s calculate revenue first. The mini-golf course is open 12 hours per day.

From 10AM – 5PM, the mini-golf course gets 10 visitors per hour. This gives us 70 visitors over seven hours. From 5PM – 10PM, the course gets 50 visitors per hour. This gives us 250 visitors over five hours. So, the mini-golf course gets 320 visitors per day.

The course is open 360 days per year, so 360 days times 320 visitors gives us 115,200 visitors. If each visitor pays $15 for admission, that is $1,728,000 in revenue per year.

Looking at costs, rent is $24,000 per month or $288,000 per year.

There are 12 staff members at all times. They work 12 hours per day at $12 per hour. This gives us $1,728 in staff costs per day. Multiplying this by 360 days, this gives us $622,080 in staff costs per year.

Adding construction costs, equipment costs, rent costs, and staff costs gives us a total cost in the first year of $1,525,080.

Therefore, profit in the first year is $1,728,000 minus $1,525,080, which is $202,920.

6. Discuss the implications of your answer

When you have finished your calculations, discuss the implications of your answer. How do the results of your calculations help you answer the overall case question? What are other considerations you should take into account?

Interviewer: How would you interpret your answer?

You: Since profit in the first year is $202,920, this just meets our friend’s financial objective of reaching $200,000 in profits in the first year.

However, I noticed that construction costs and equipment costs are a one-time fixed cost. Although there will probably be future maintenance costs, our friend would not incur $615,000 of these costs again in the following years. I’d expect profits in year two and beyond to be much larger than the first year.

I also noticed that the mini-golf course employs 12 people at all times. Is there a reason for this? I’m wondering if there are opportunities to use machines to replace some of the repetitive and manual tasks that these employees do. This may further increase profits by decreasing costs.

7. Deliver a recommendation

At the end of the Capital One case interview, the interviewer will prompt you for a recommendation. Make sure to structure your recommendation so that it is clear and easy to follow. You can use this simple, but effective structure:

- State your recommendation

- Provide 2 – 3 reasons that support your recommendation

- Propose next steps

Here is an example of what a recommendation could look like:

Interviewer: Thanks for all of the work that you have done so far. What is your final recommendation?